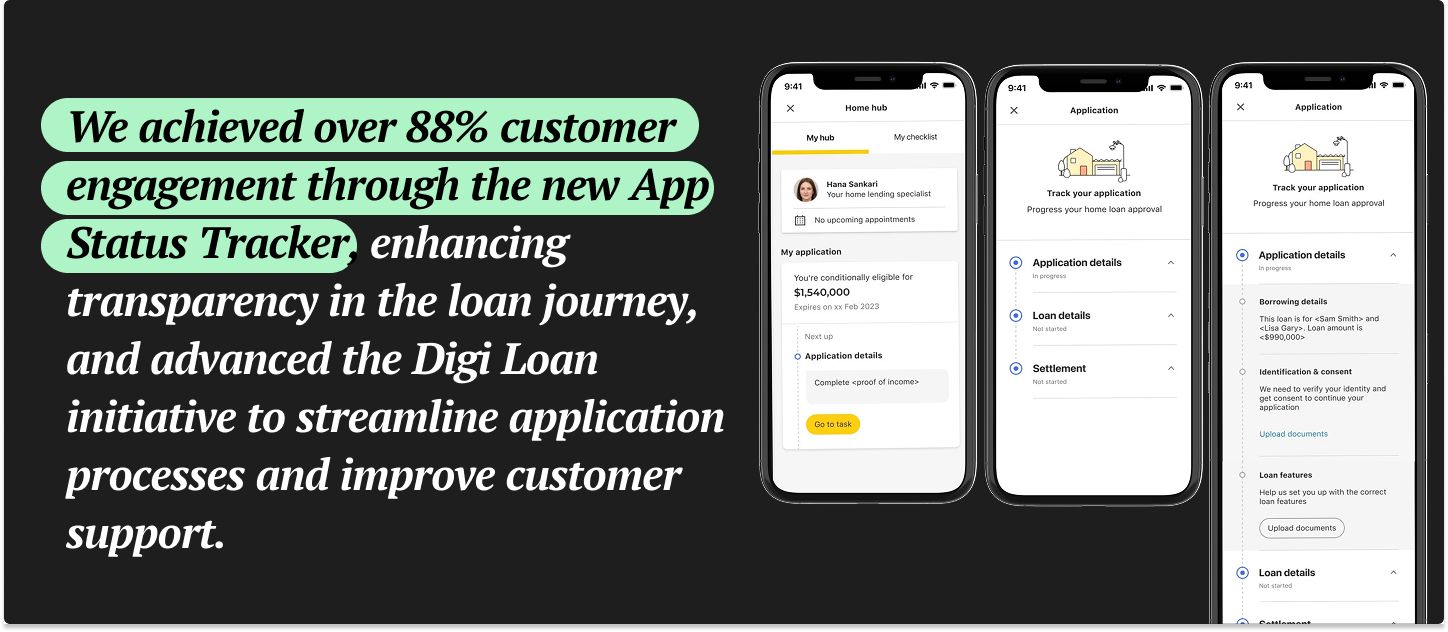

The Application Status Tracker is one of the strategic projects that I worked on. it’s a transparent, real-time home loan application tracker in the CommBank app that simplifies the process, providing quick updates, actionable next steps, and a seamless, paperless journey to approval.

Team: As the sole product designer, I collaborated closely with a researcher, product owner, engineers, copywriter, and UI designer.

My role: I led end-to-end strategic design, research planning, ideation, prototyping, and delivery.

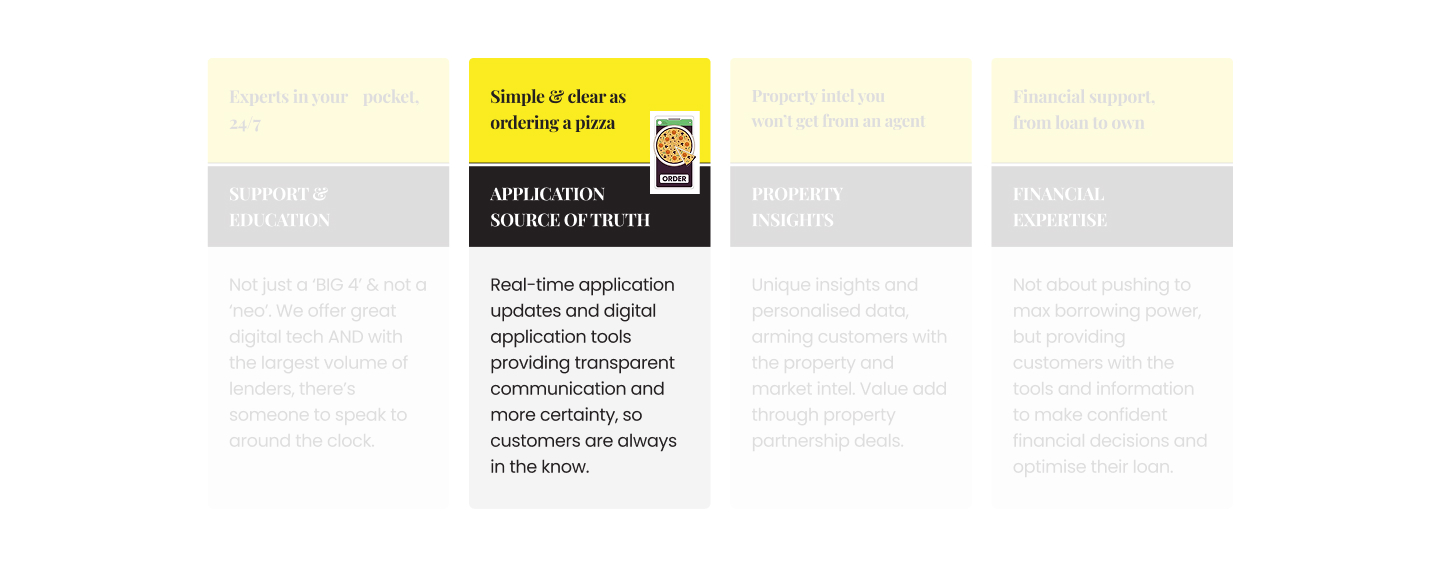

4 Home hub pillars that will set us apart

• Complex, lengthy home buying/refinancing with multiple parties.

• Poor transparency and omni-channel experience.

• Overwhelming process due to jargon and unclear steps.

• Clear guidance on home buying steps.

• Real-time loan status updates.

• Simple instructions for next actions.

• High customer dropout rate (47%) due to complexity.

• Heavy reliance on paper documents.

• Manual validation effort (34 FTE).

• 200 daily calls due to lack of real-time status updates.

• Simplify processes to reduce dropouts.

• Improve transparency and customer confidence.

• Increase conversions and engagement.

• Decrease complaints and enhance feedback scores.

• Increase digital application approval rate (35% → 42%).

• Reduce required documentation.

• Decrease manual processing time.

• Lower customer stress and calls to lenders, freeing Ops capacity.

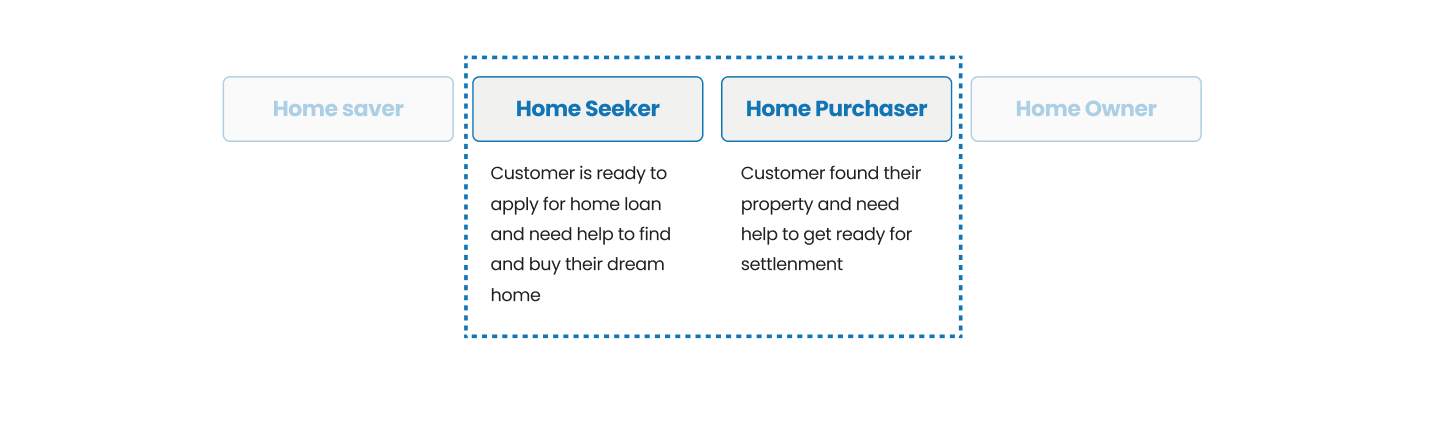

First-time home buyers are our main target audience, as they are unfamiliar with the process and need more guidance on what to do and what to do next. Refinancing customers and subsequent buyers can keep track of their applications.

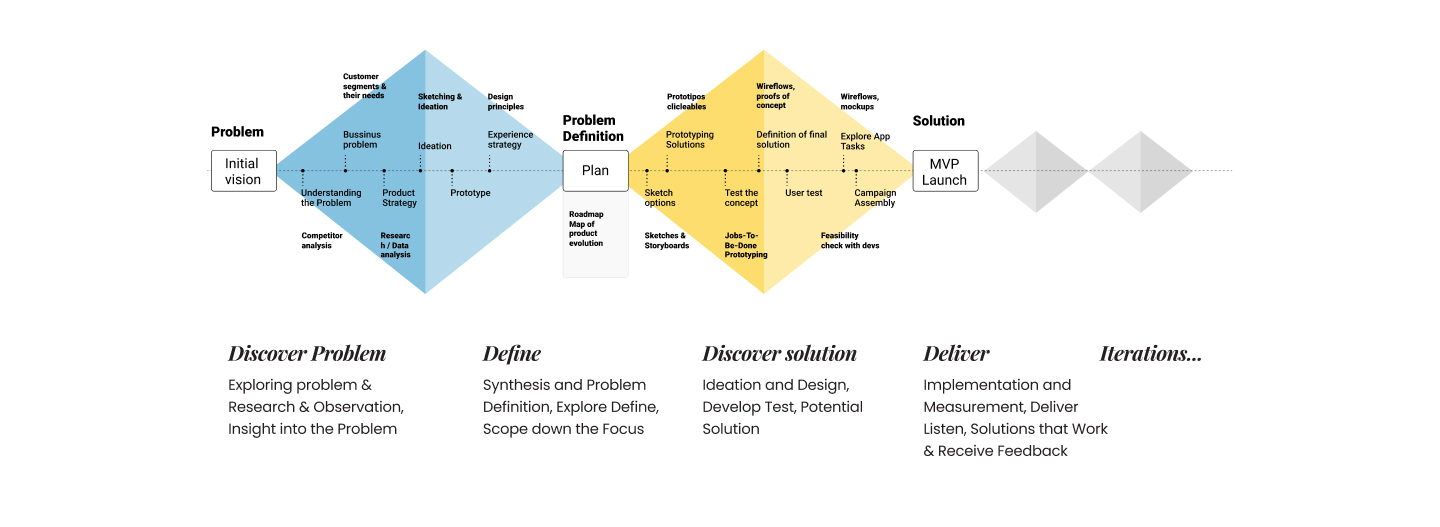

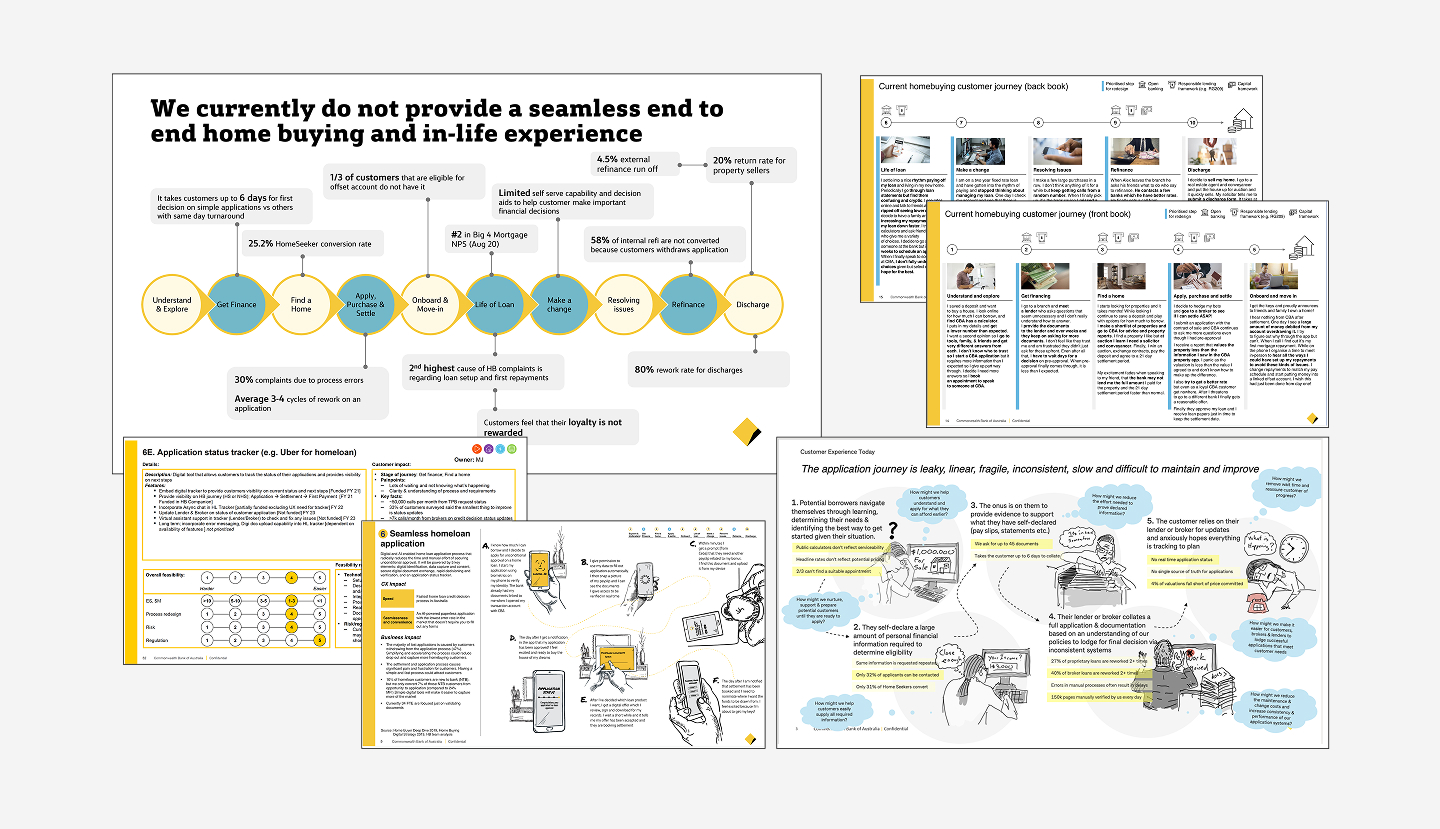

I dug deeper into the problem, gathering insights from agency research on the end-to-end HB journey. This helped prioritise key issues.I captured customer pain points in the HL application, shared them with the team, and ensured alignment on what to address first.

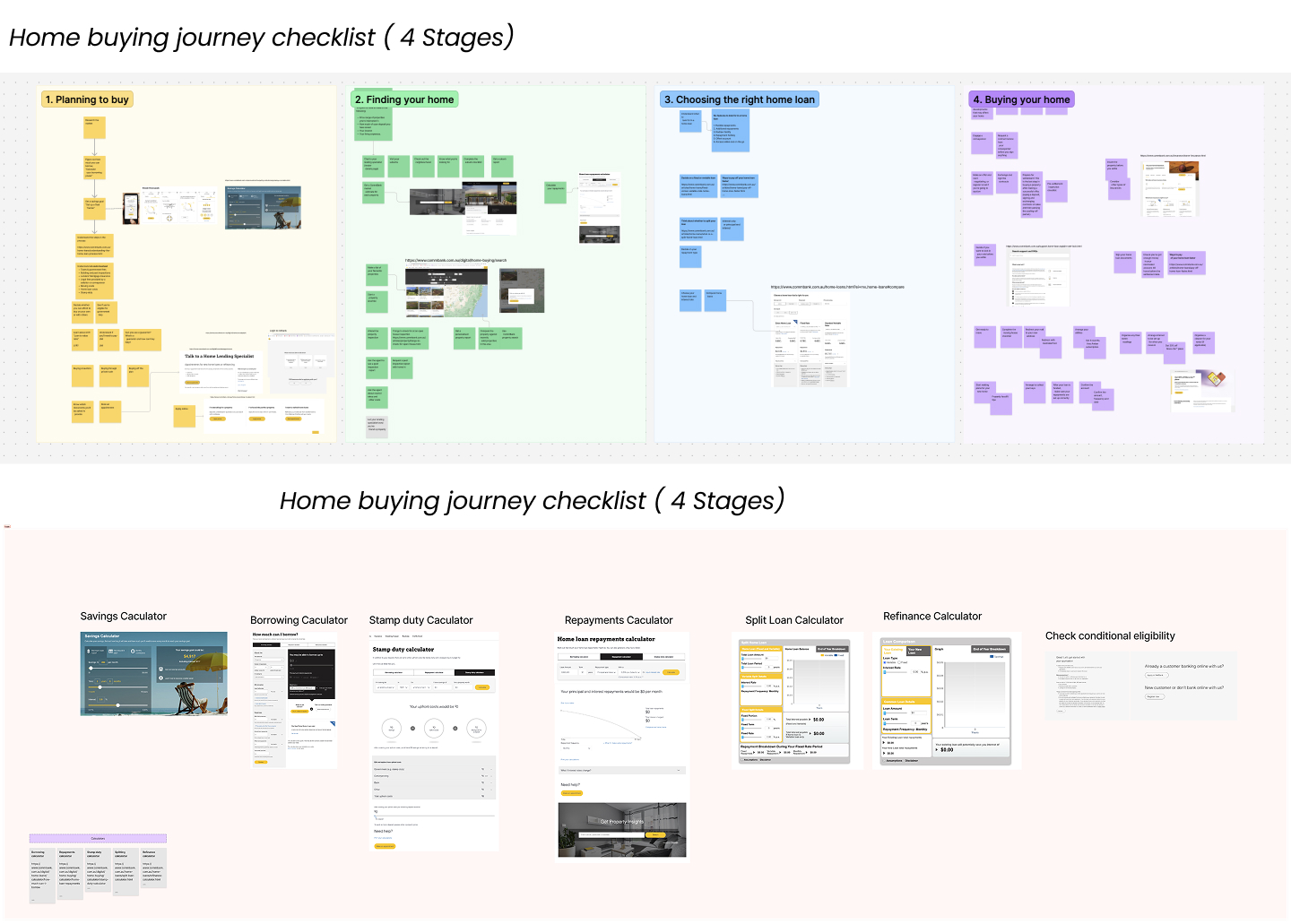

I created this checklist to deepen my understanding of the steps that customers go through and the tools they use in each phase to help them achieve their goals.

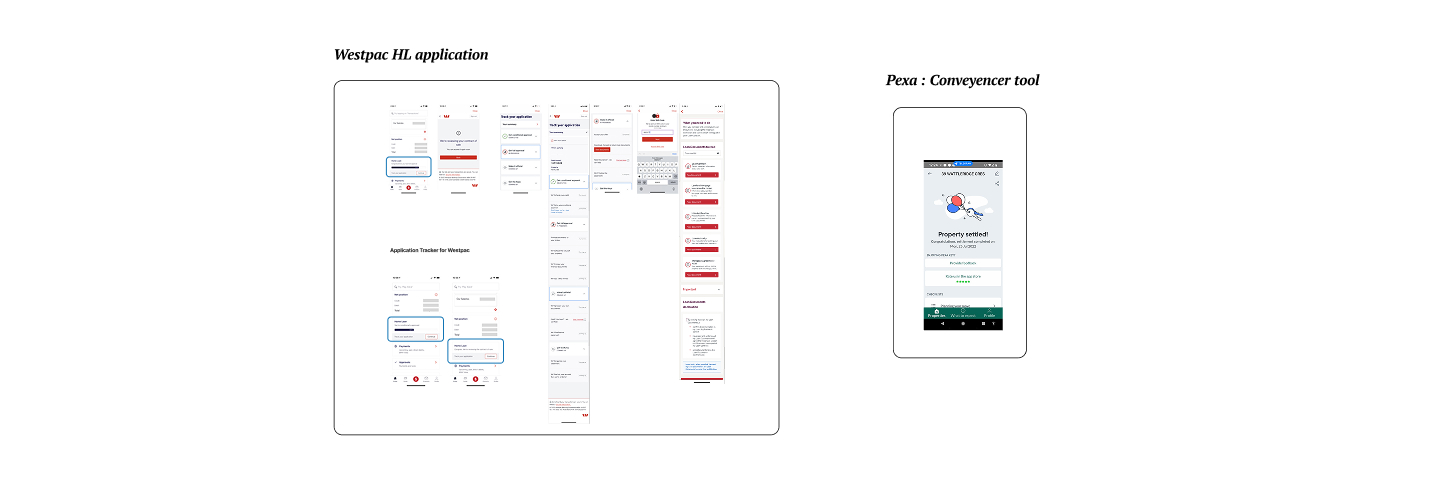

I had limited ability to review our competitors' solutions and assess their strengths and weaknesses, as I would need to open a home loan application with them to evaluate the process. QR

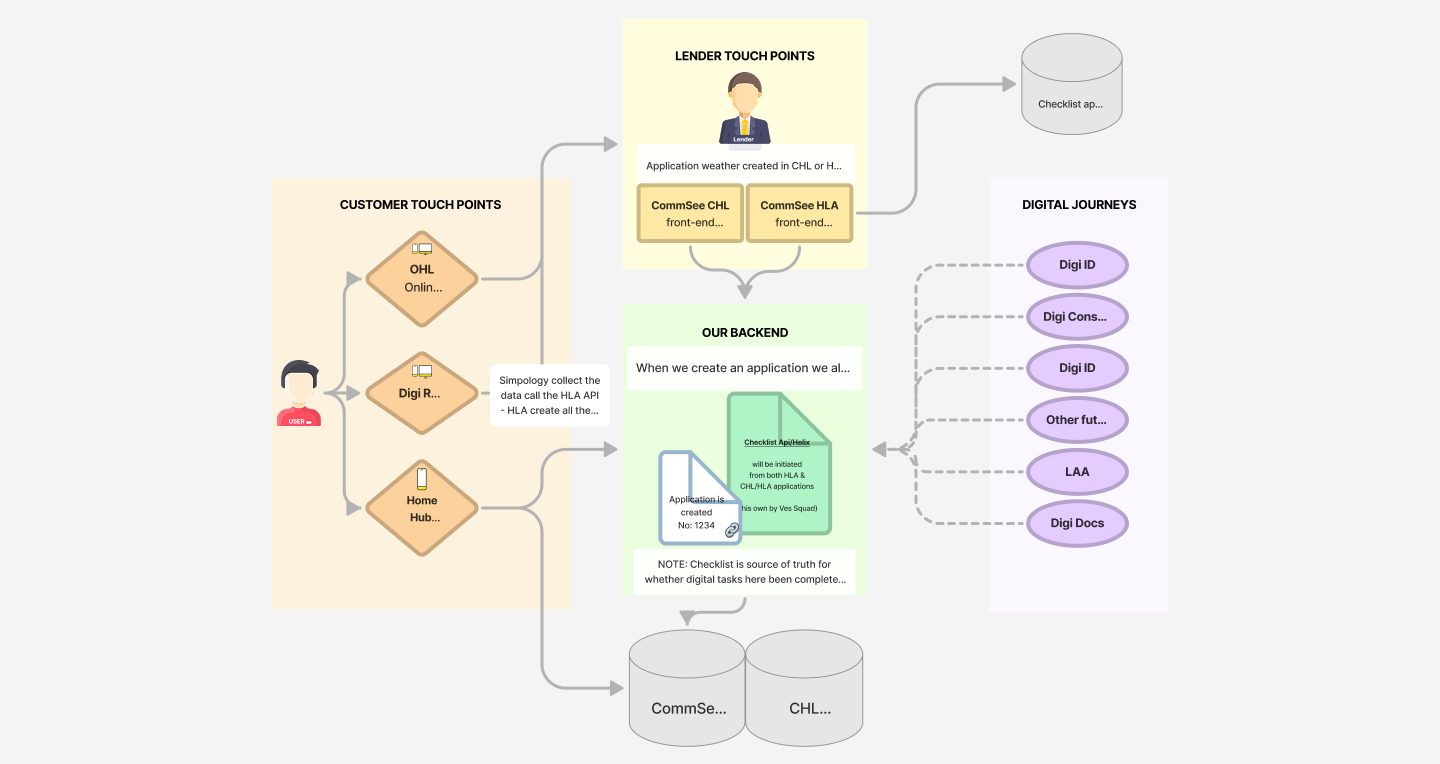

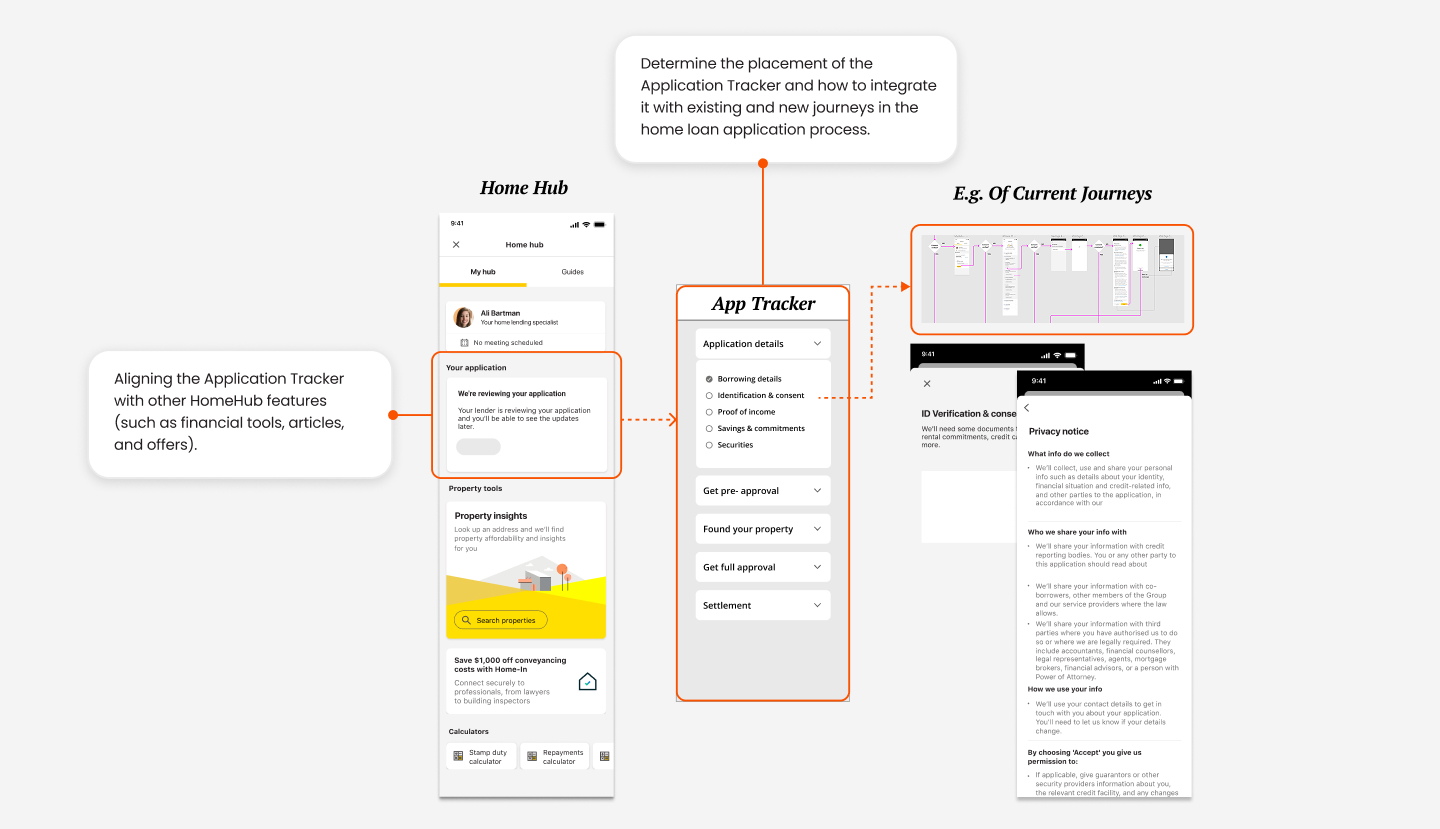

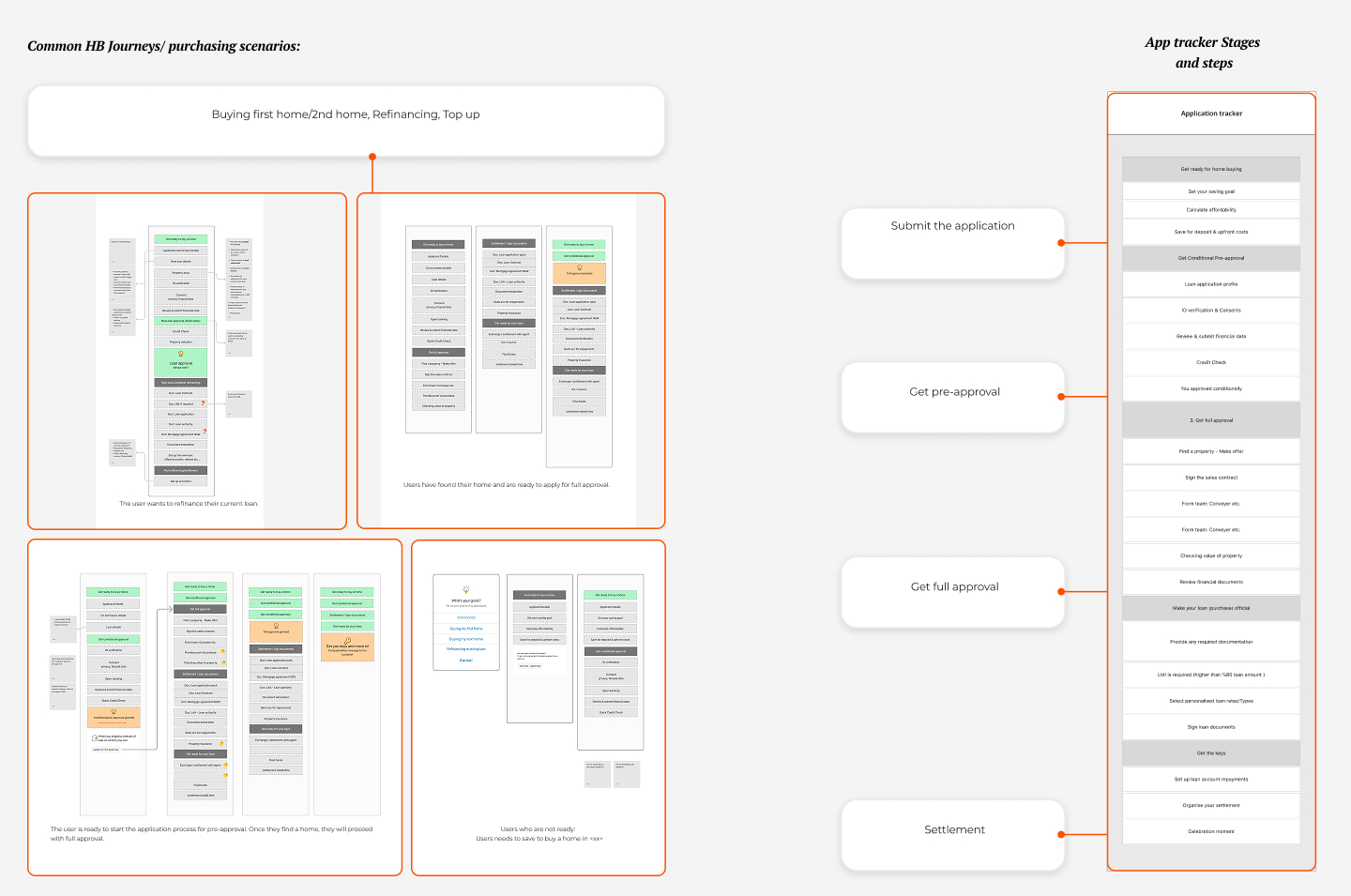

I created a system map to clearly understand where the Application Tracker is gonna fits into the overall journey and how it interacts with various customer and lender touch points. Given the complexity and variety of existing digital journeys, it was essential to map these journeys and understand their placement within the Application Tracker to streamline the process. This map was crucial for gaining a clear picture of how the Application Tracker interacts with all touch points, enabling a more informed design process.

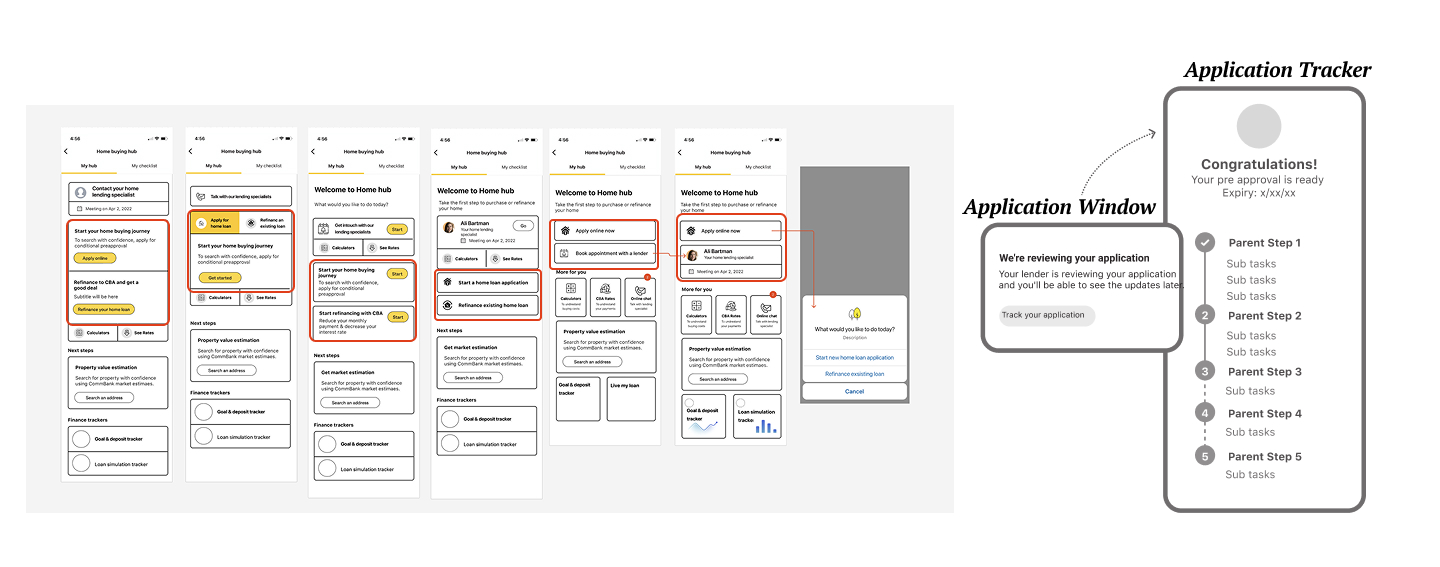

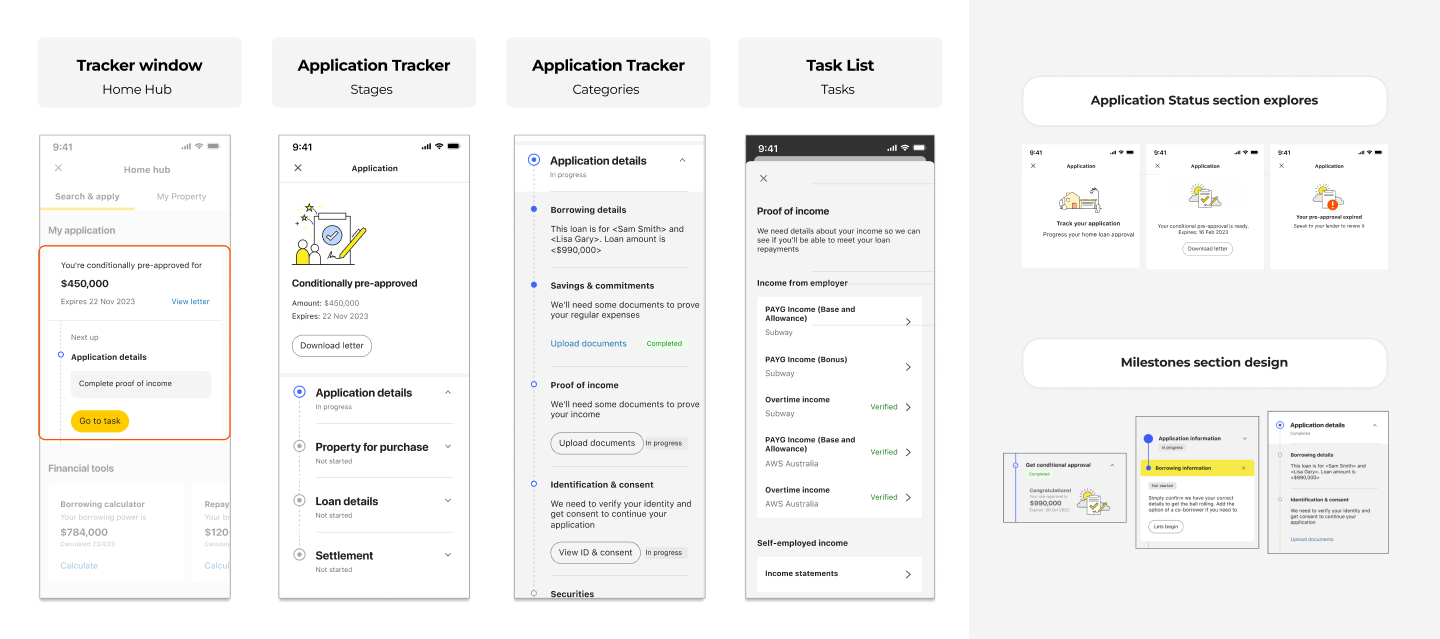

Since this new feature was part of the Home Hub app, it was essential to ensure the Application Tracker seamlessly integrates with it. This approach aimed to provide users with a centralised and cohesive experience that aligns with their broader financial and home-buying journey.

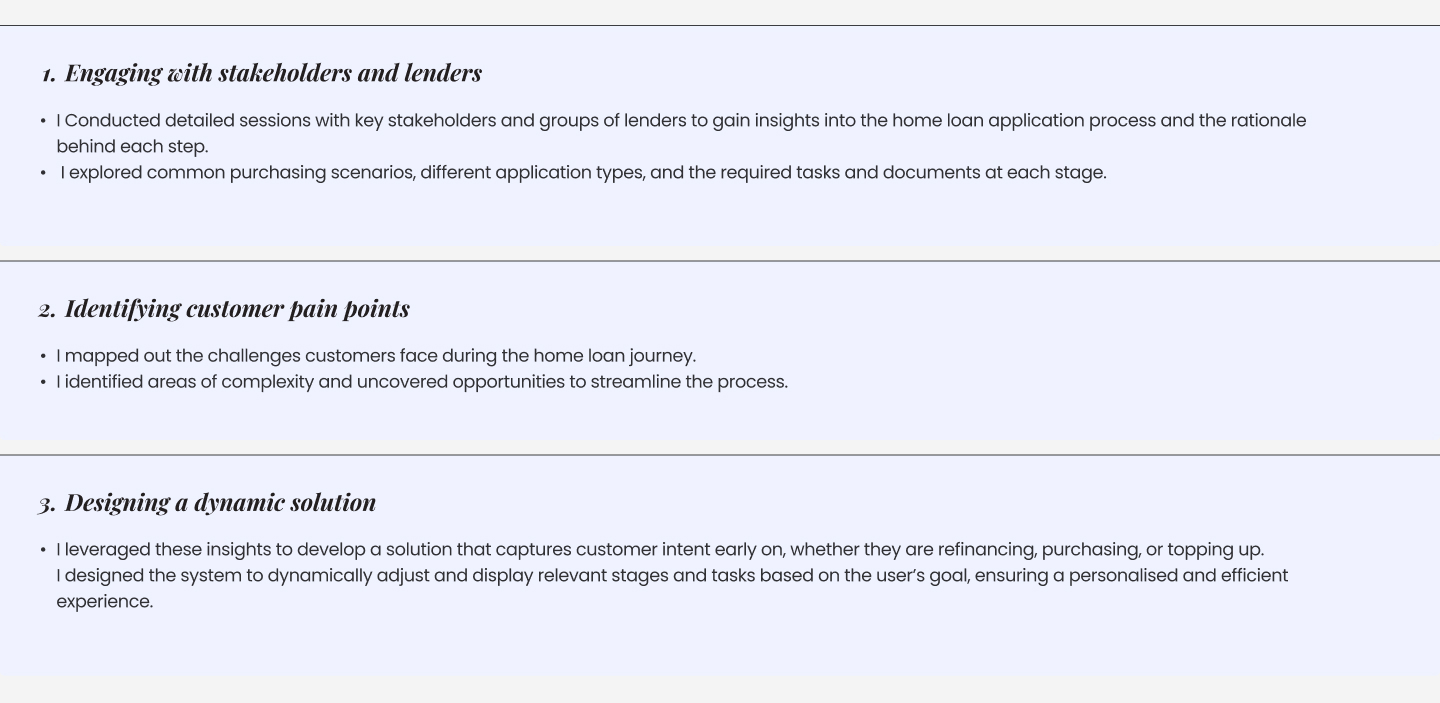

To create a dynamic and user-centric Application Tracker, it was crucial to thoroughly understand the stages and tasks involved in the home loan process. In order to do that I started:

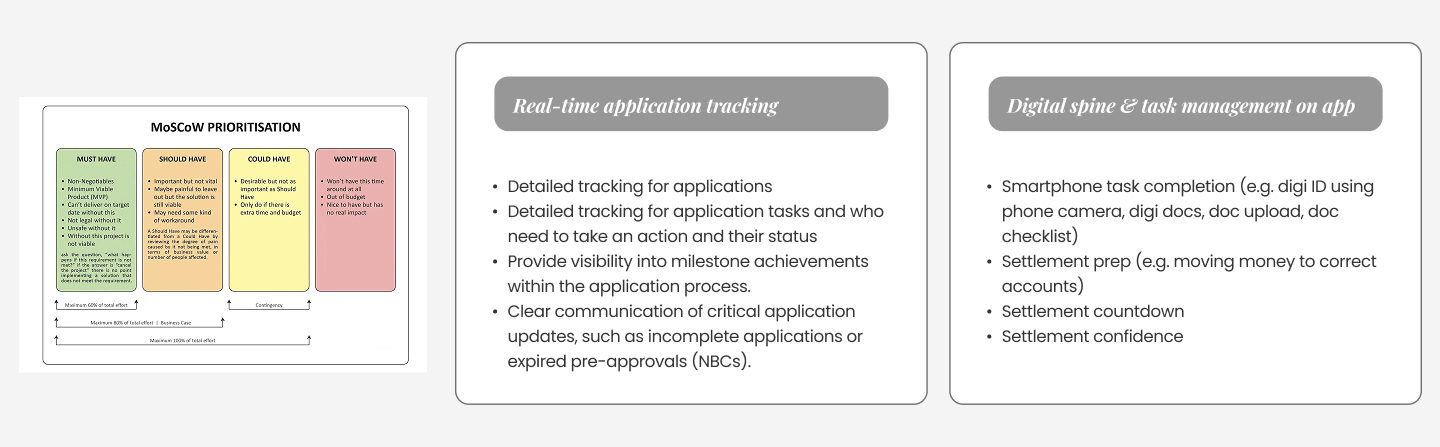

To deliver early value to our users, I created a list of key features that address their core needs while aligning with business objectives. I then discussed and refined this scope with my Product Owner (PO).

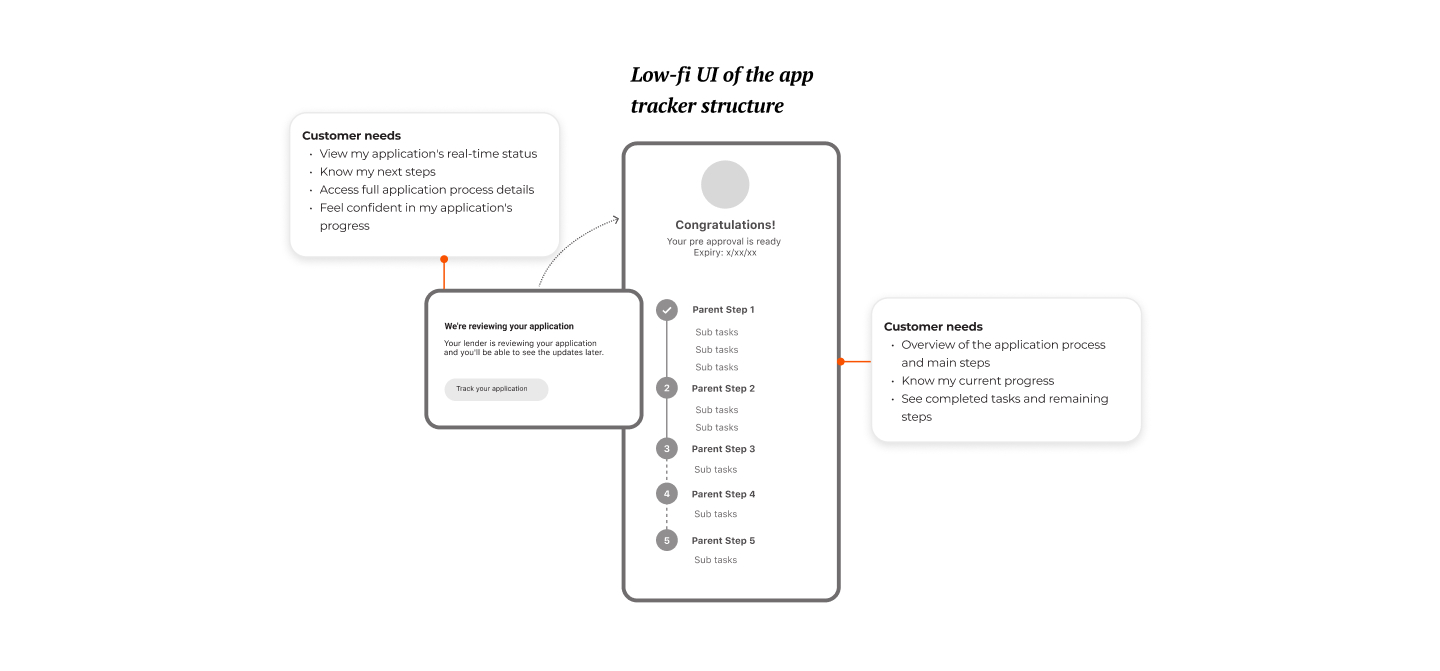

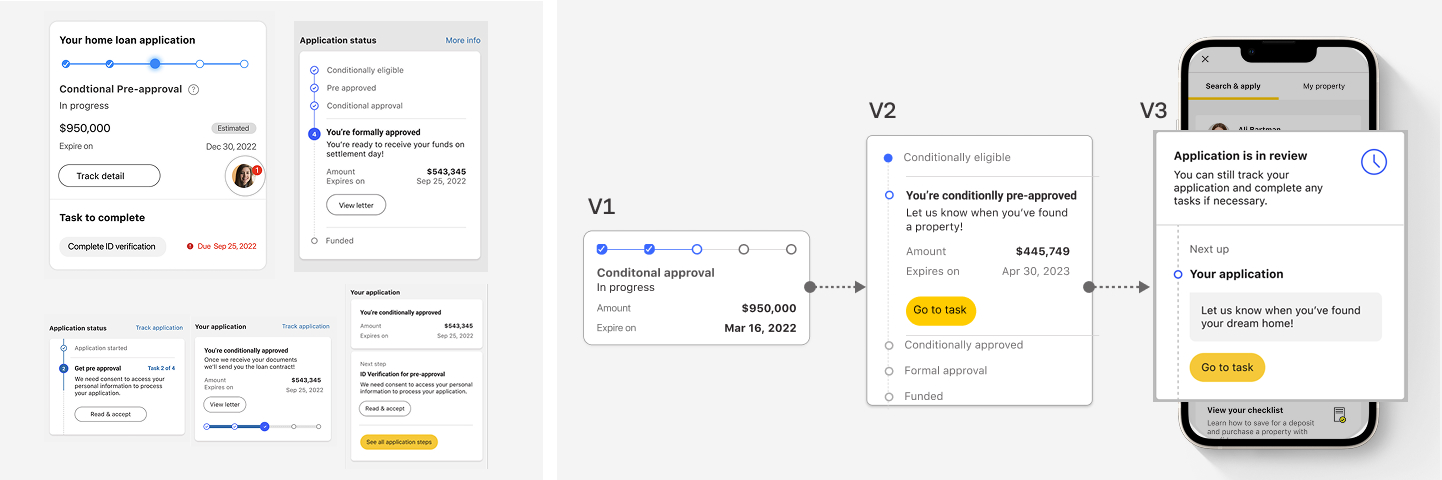

Then, I started sketching and wire framing potential solutions with our UI designer. Before we began working on the UI, we conducted multiple ideation sessions focused on the Information Architecture (IA) based on the customer needs .

Here are some of my ideation for application window in Home Hub

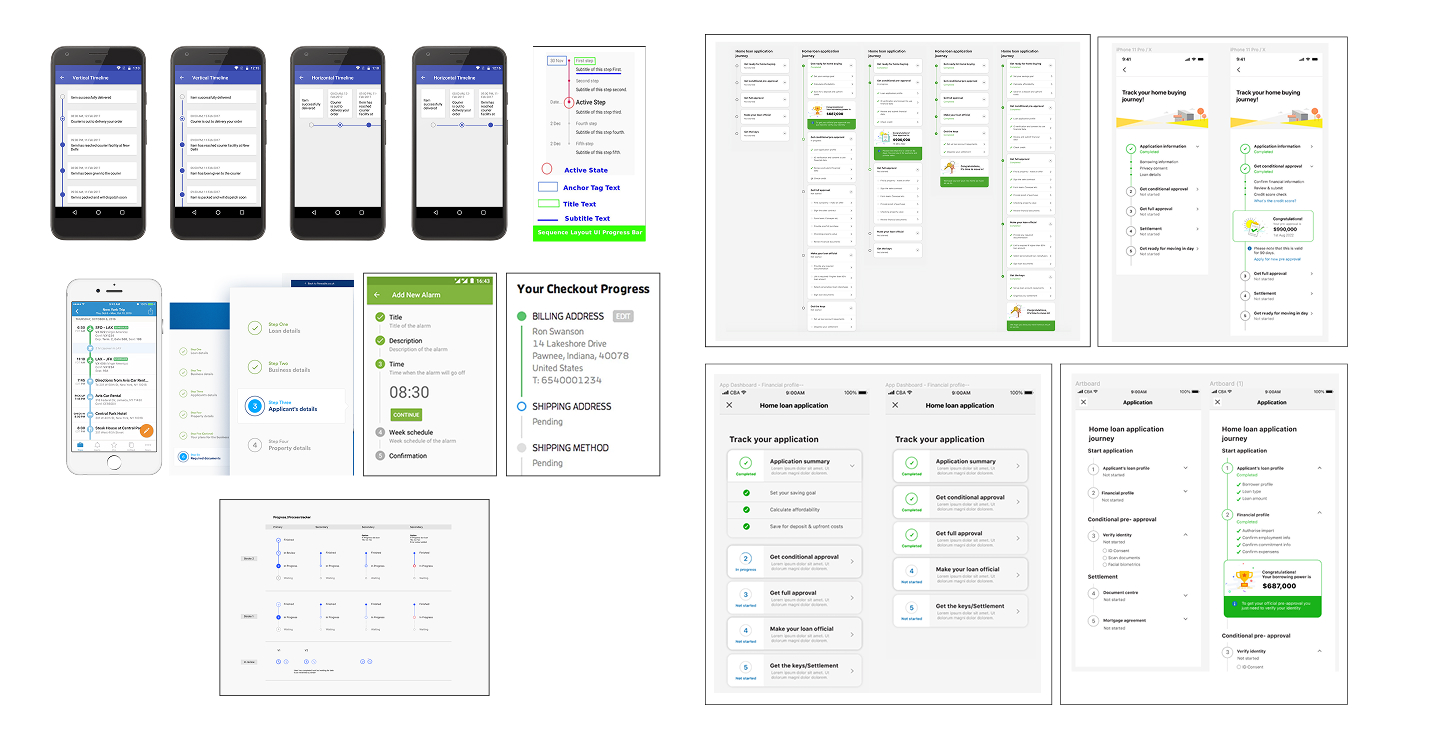

I searched through a ton of reference material, exploring other design systems and how they visualised journey trackers. Most of which used a numbered linear path. Our existing timeline in our design system limited us to present info clearly to the customers & couldn’t address our needs so we went through creating new design pattern for timeline

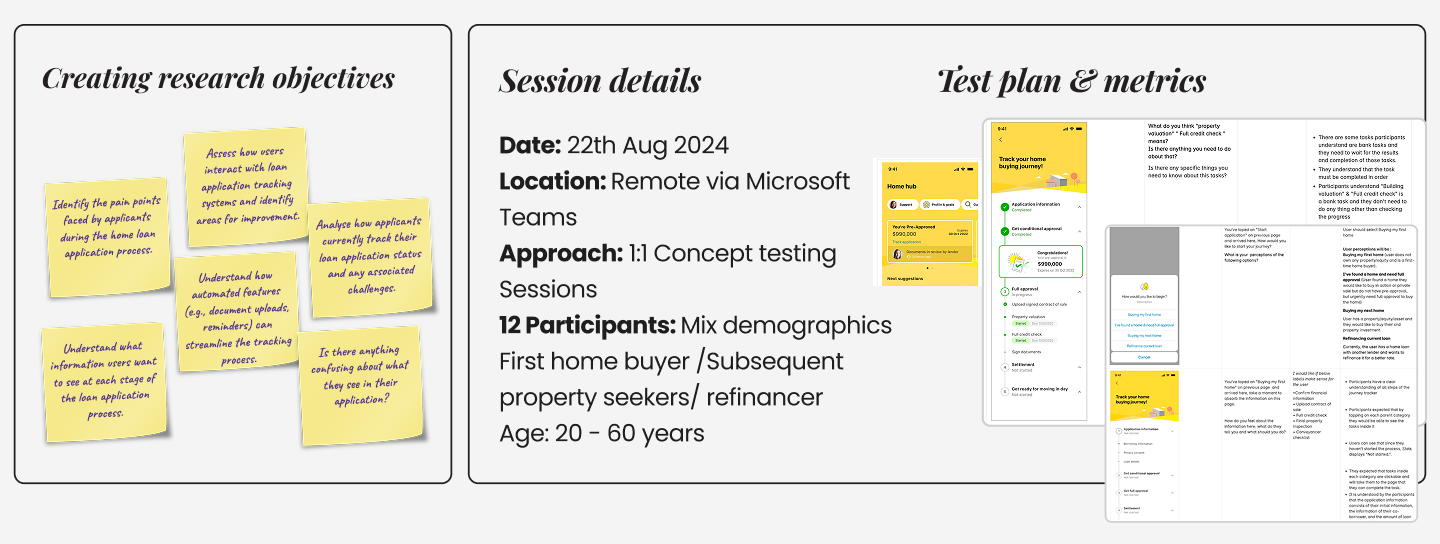

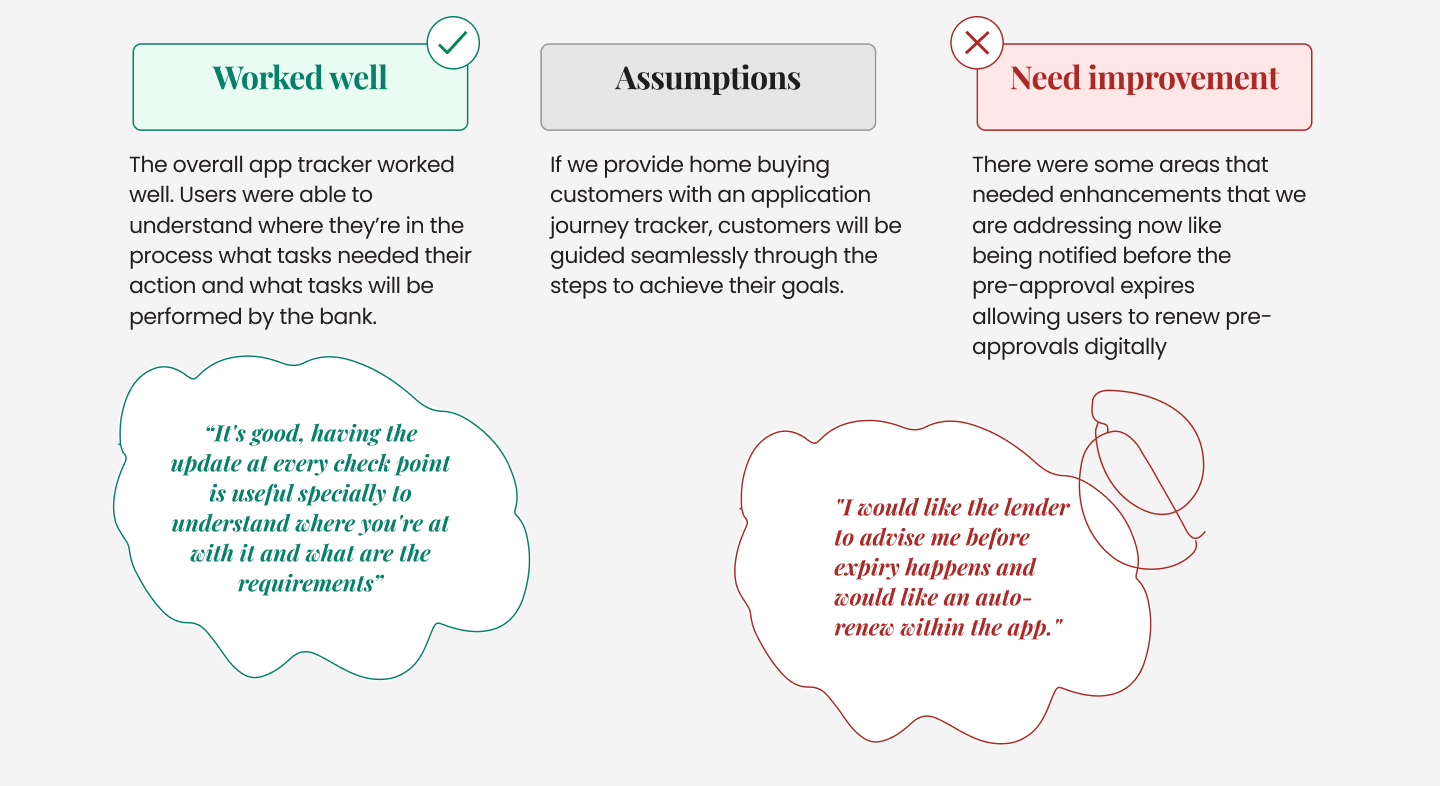

I created the research objectives & hypothesis for the concept testing

To verify that our solution works for the user, we took the design to testing. I set up a workshop with the research team and introduced them to the project. I created high-fidelity prototypes and start testing them with users. to validate assumptions and improve the design based on real user feedback.

To assess the feasibility of the solution, I organised a meeting with my PO and our developers. We identified the necessary fixes to transition from the current state to the future state, aligning with the project delivery timeline. This approach helped us validate assumptions and refine the design based on real user feedback.

Our existing “Timeline/ progress tracker” component in our design system limited our ability to present information clearly to customers and didn’t meet our needs. As a result, we created a new design pattern for the timeline.

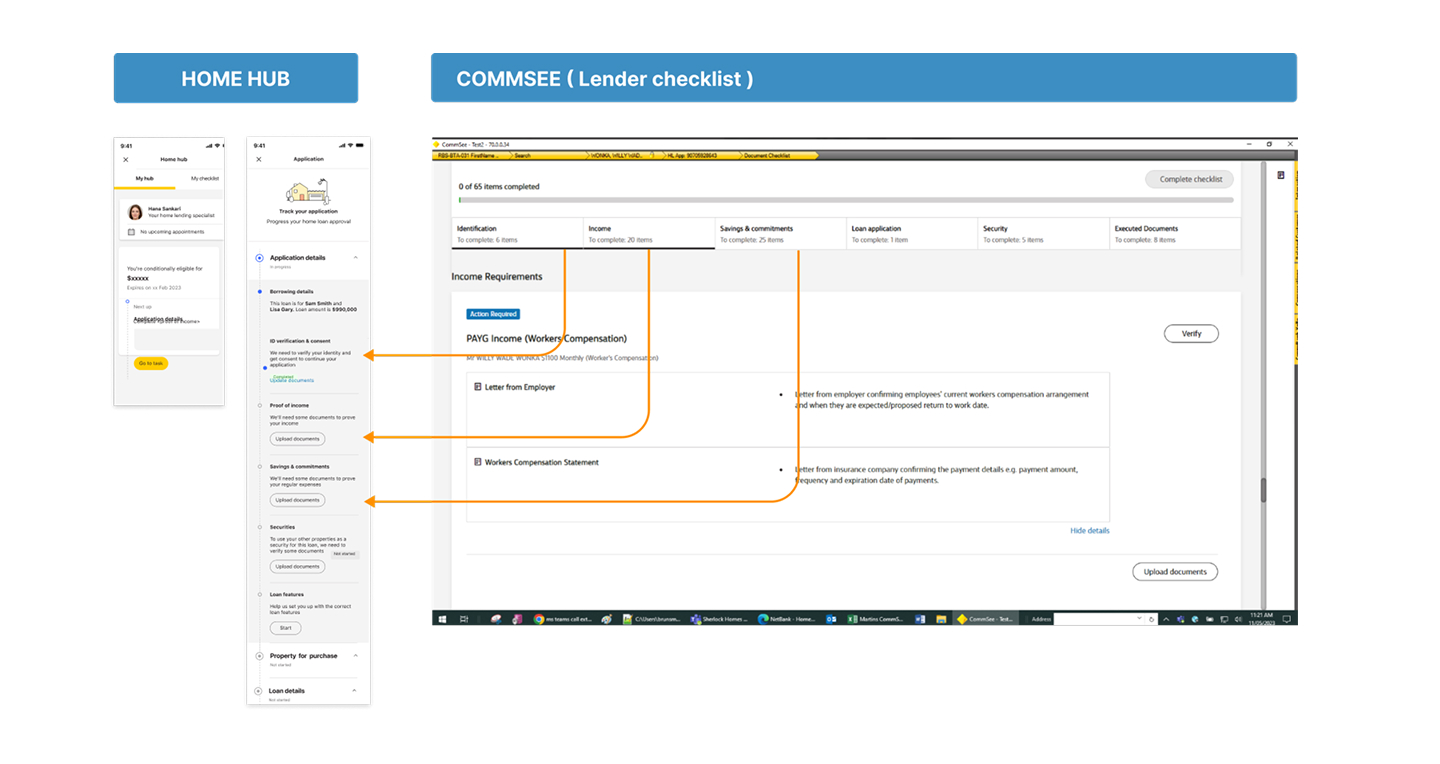

I worked closly with squad and engineers to learn more about lender checklist and how the task there can connect to application tracker

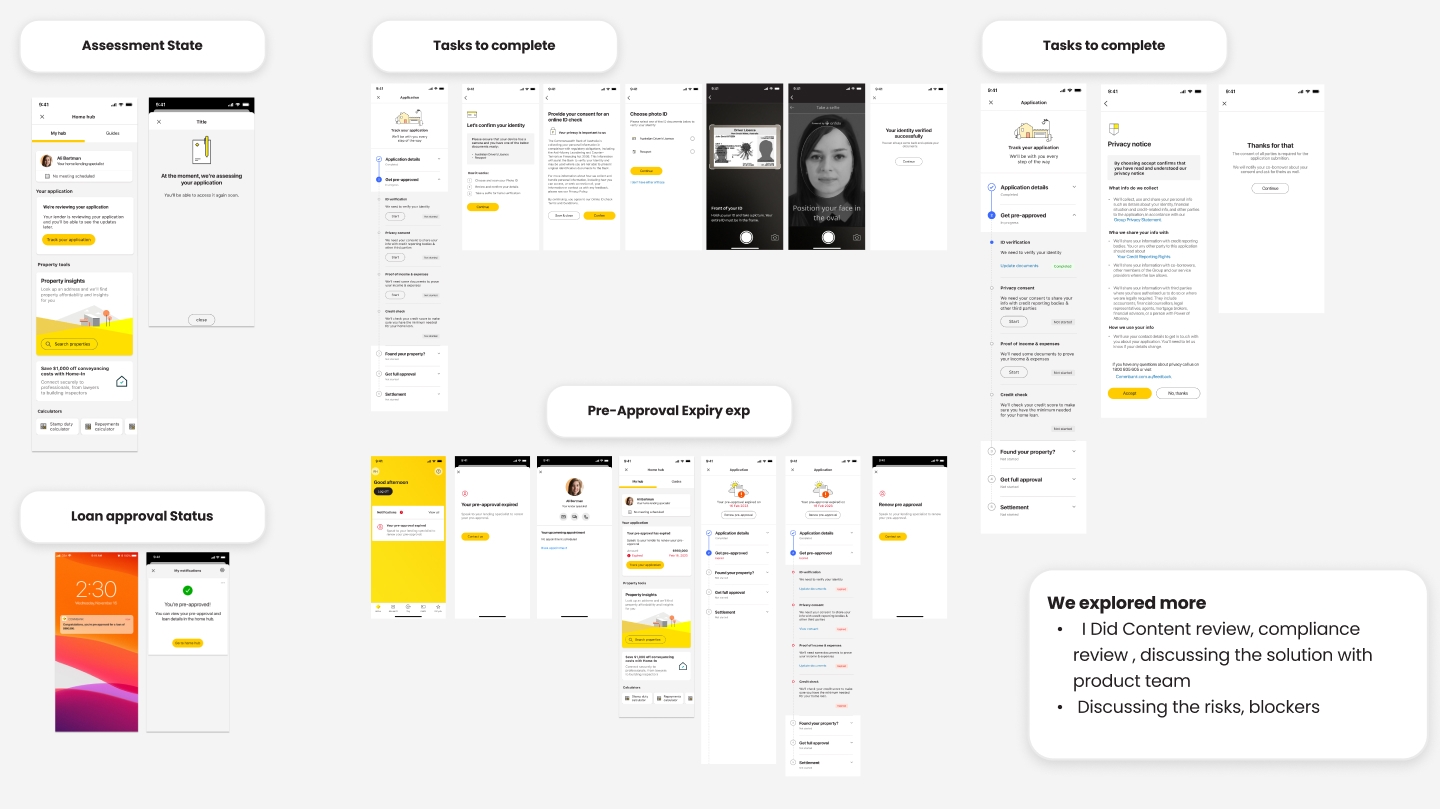

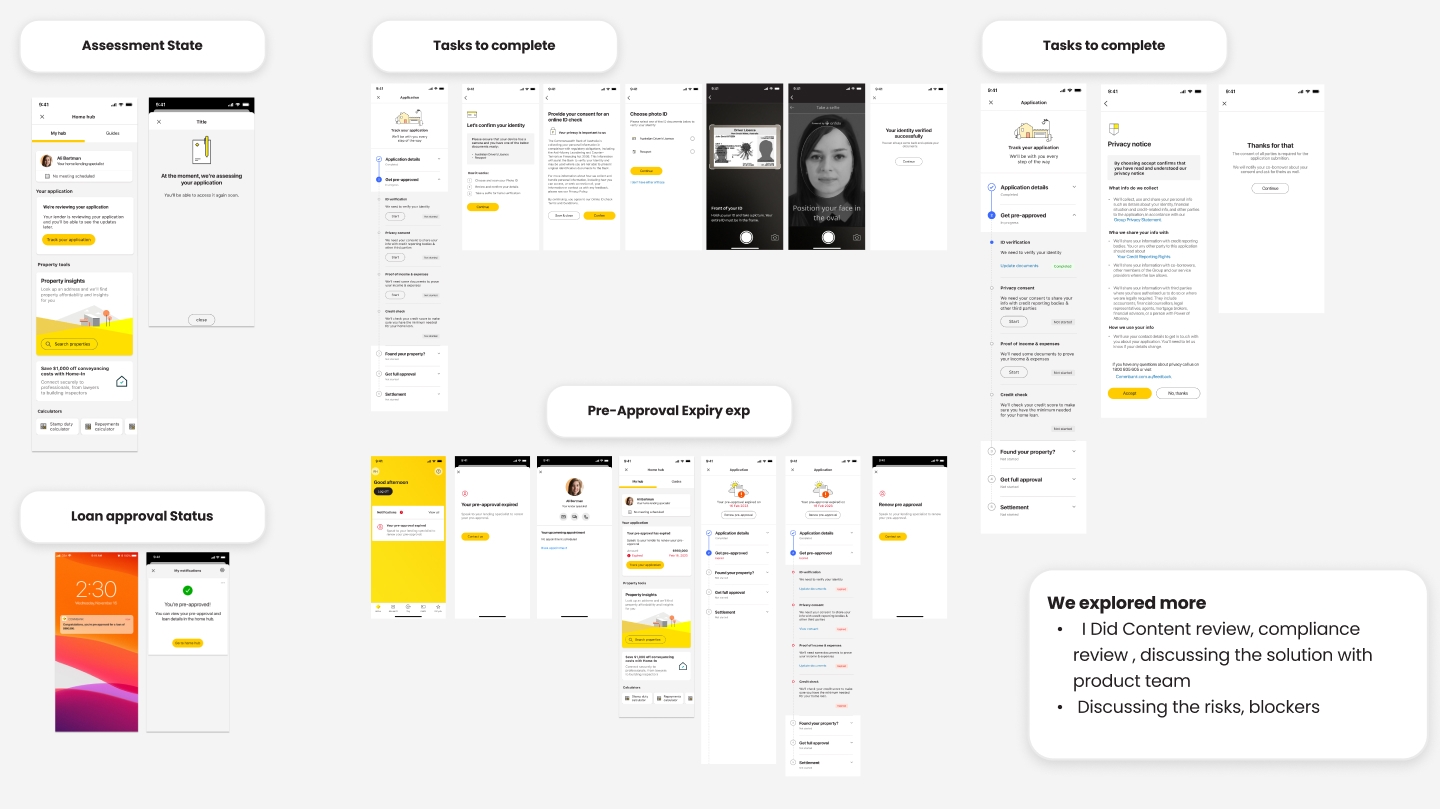

I defined clear guidelines and rules for how the tracker operates, including identifying categories, tasks, and clarifying sources of information. Additionally, I conducted content reviews, ensured compliance, discussed solutions and potential risks with the product team, and addressed any blockers.

Lastly, I dove deep into each task and journey, exploring how they could connect to the application tracker and enable users to complete the tasks assigned to them.

• Due to the organisation restructuring happened App tracker handed over to another team

• A design backlog created for for future app tracker enhancements and values

• Recognition for achieving 88% customer engagement with our new App status tracker( Referring to Horizon 2 of App status tracker)