When CBA sold its insurance business to Hollard in October 2022, policy management moved from CommBank’s legacy i90 system to Hollard’s Duck Creek platform. Although customers still apply through CBA, after renewal everything lives in Duck Creek. Creating risk of confusion and churn at renewal time.

Team: I was the sole product designer on this strategic project, collaborating with a researcher, product owner, engineers, a copywriter, and a UI designer.

My role: I was responsible for end-to-end strategic design, Research planning and providing the test plan, ideation, prototyping, and delivery.

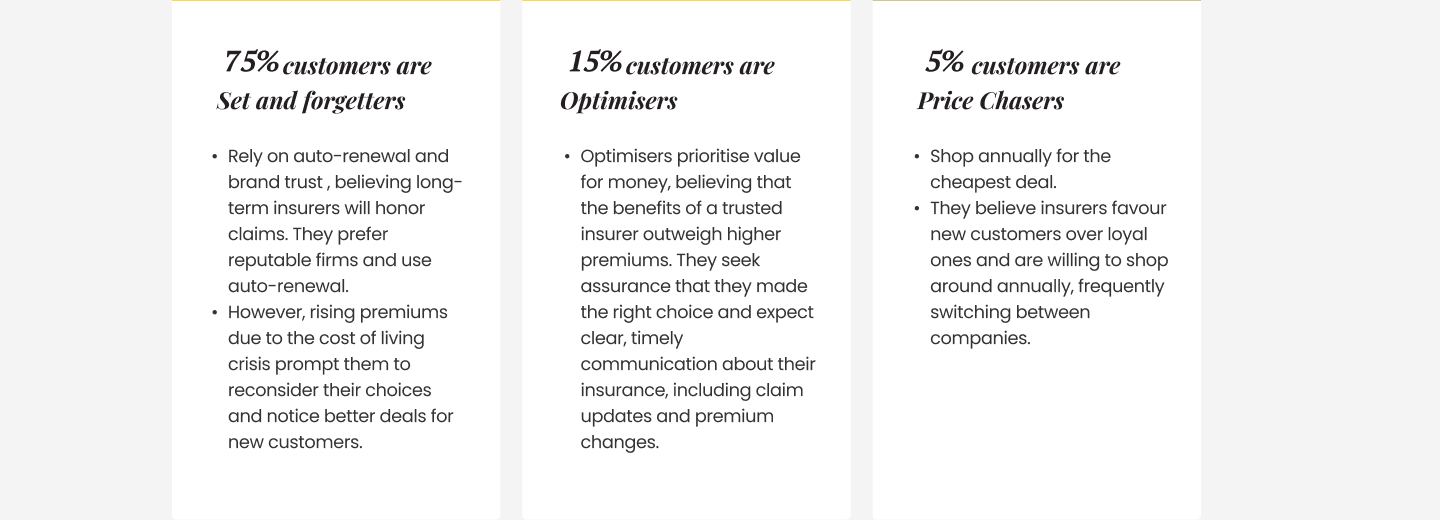

The insurance renewal process is complex, leading to customer churn during the migration from i90 to Duck Creek products. We aimed to simplify this transition and enhance communication throughout the customer journey. High churn at renewal: 40% of home-insurance customers “insured elsewhere,” 50% of car-insurance customers “sold asset.” Communication gaps: Customers need timely, clear, tailored messaging.

• Reduce policy cancellations by creating a clear, seamless renewal path (e.g. Renewal Hub, in-app & email notifications).

• Improve engagement with our Renewal Hub so customers understand changes and feel confident renewing.

• Addressing churn drivers like insufficient communication and perceived lack of value

• Increased retention rates (84% → 88%)

• Increase Renewal Hub engagement (If the new experience helped customers understand the renewal changes and reduced confusion)

• Improve “Manual renewal” retention

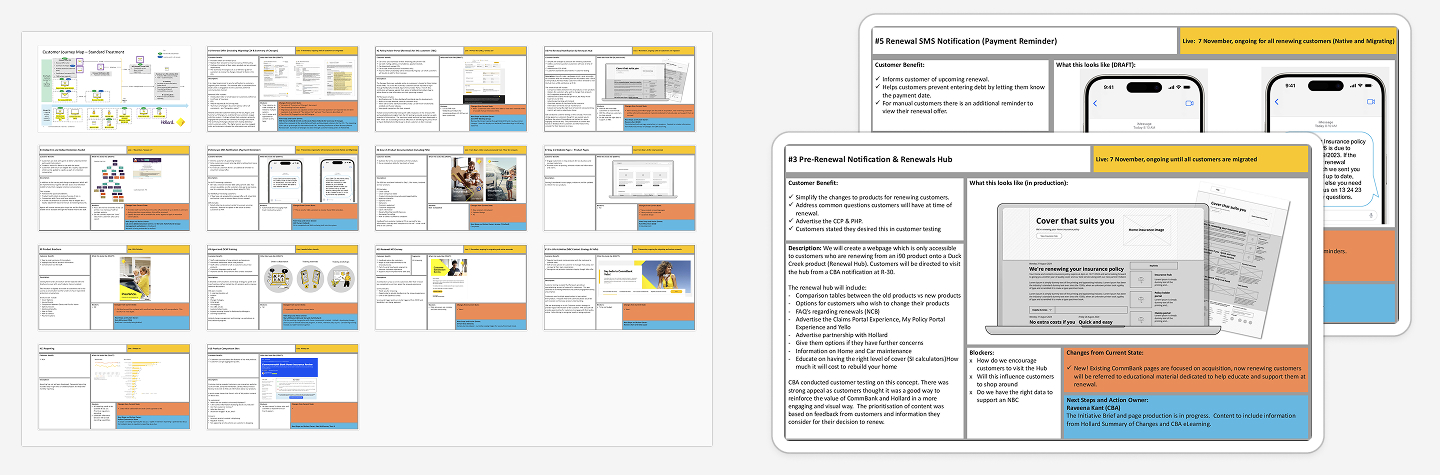

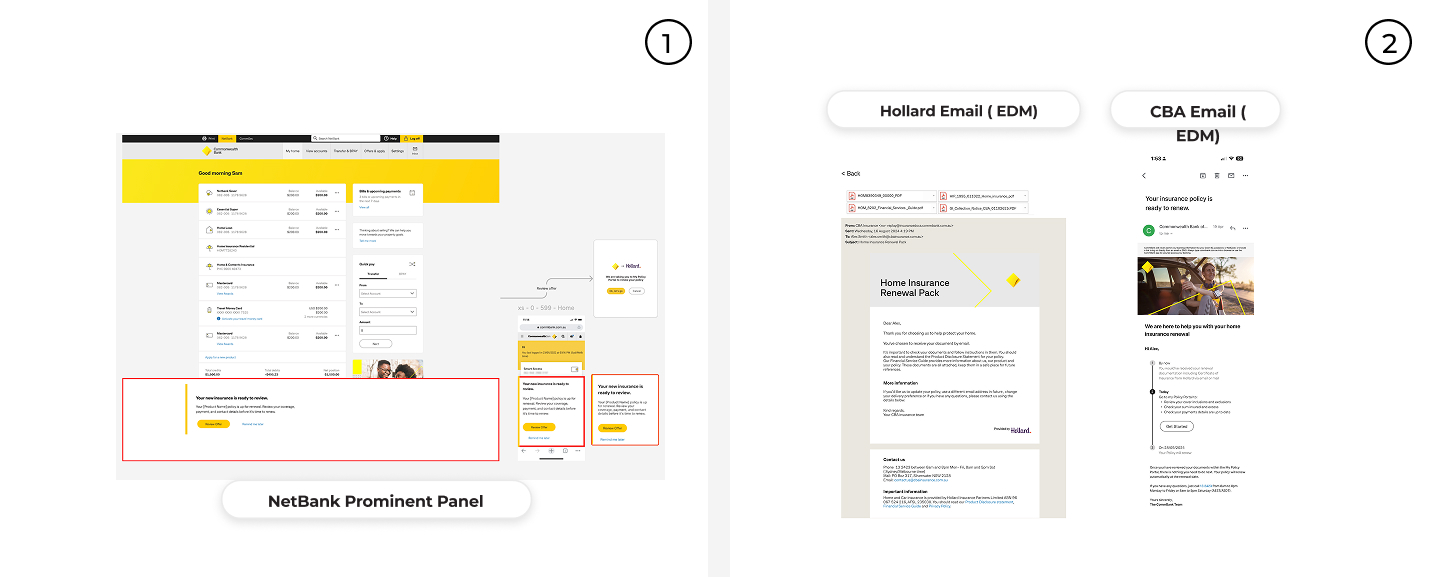

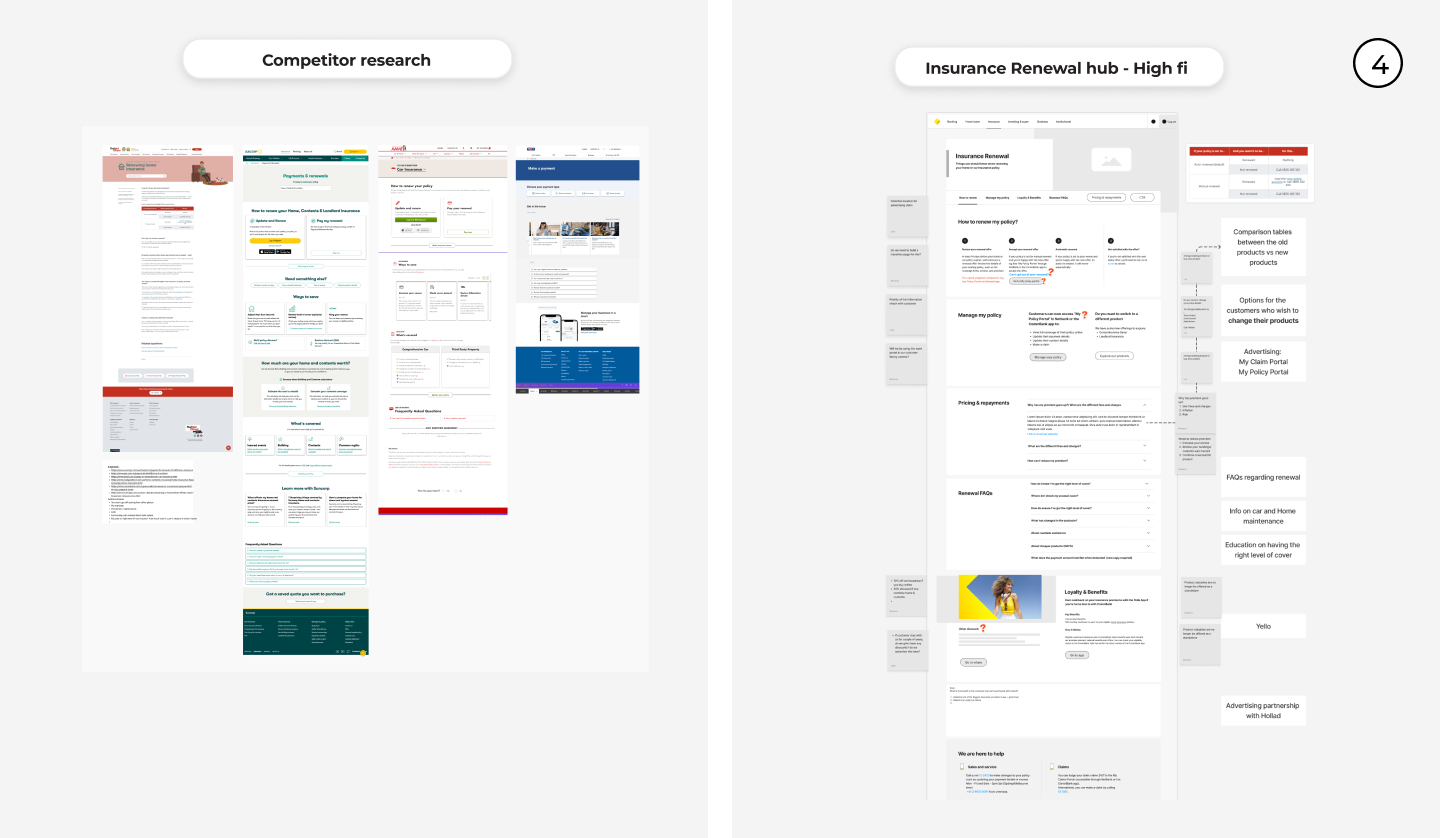

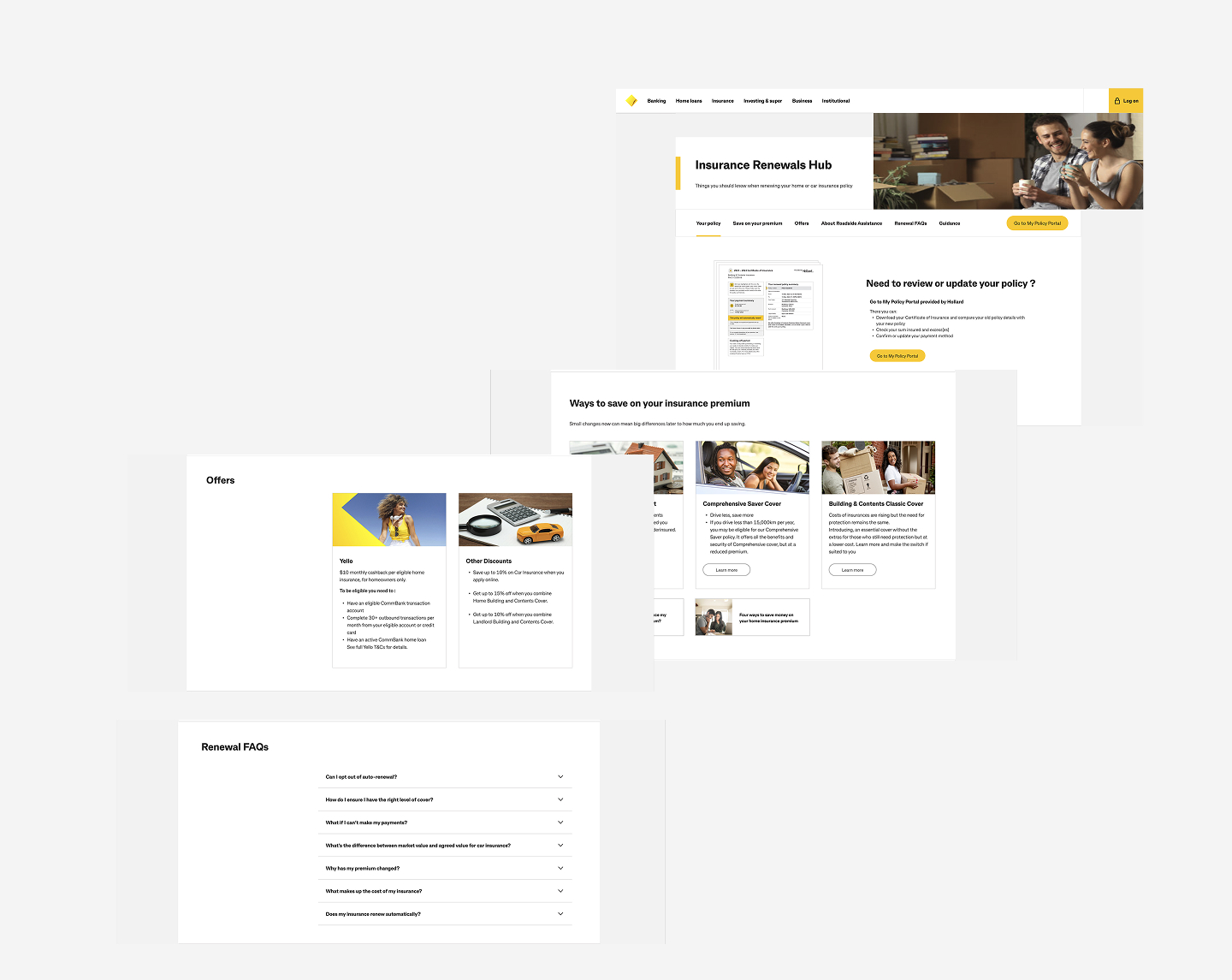

To simplify the renewal journey and address customers' concerns, a renewal hub page on the CommBank website will provide valuable information, such as what customers should know about renewing their policy, Highlights of the changes between the old and new policy coverage & Information about discounts and extra resources available. This will ensure customers have all the details they need for a seamless renewal process.

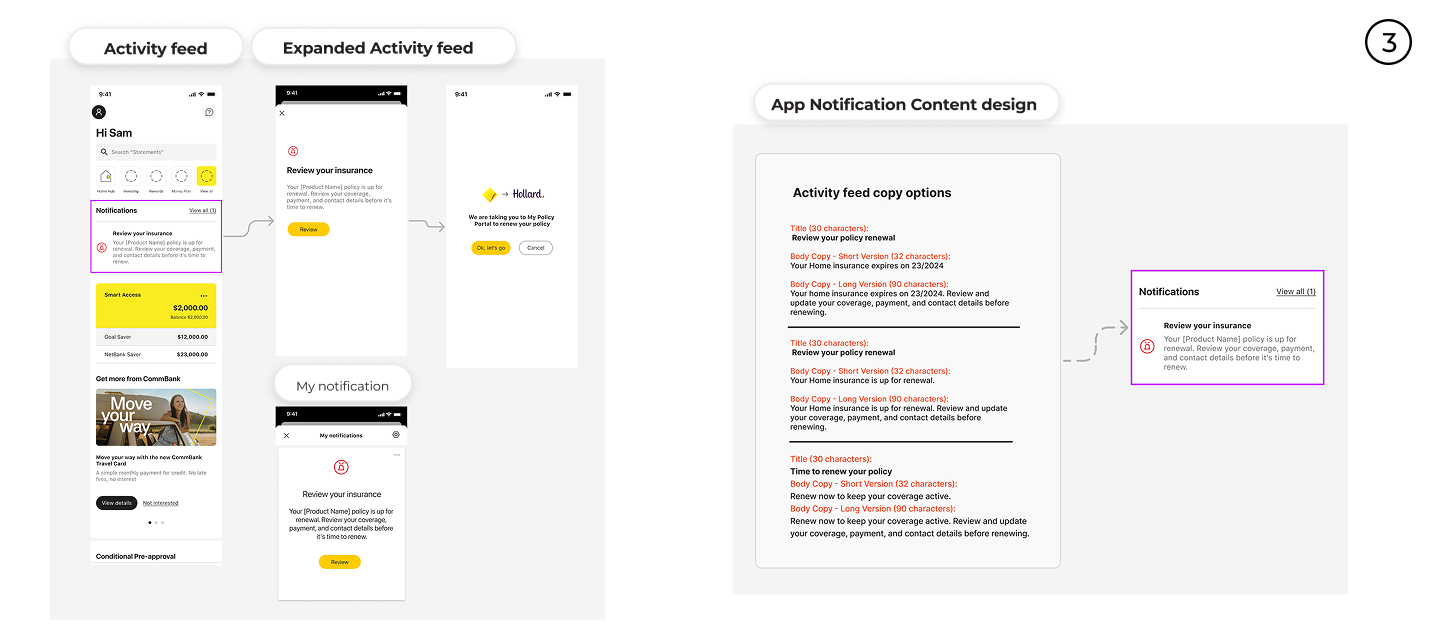

Customers appreciate receiving renewal notifications and reminders via email and in-app :

• 30 days in advance for the initial renewal notification

• 2 weeks in advance for reminders

• Email is an important record-keeping device for personal administration

• Customers may feel a sense of shock due to significant changes in their policy

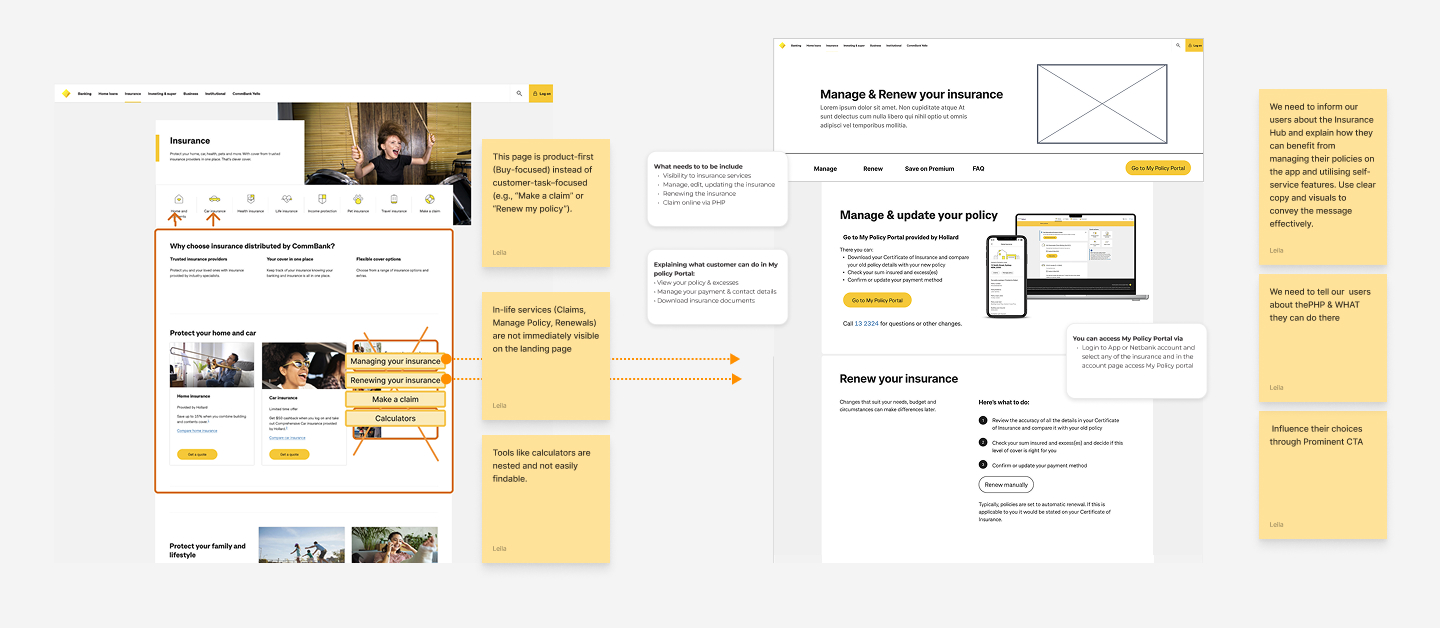

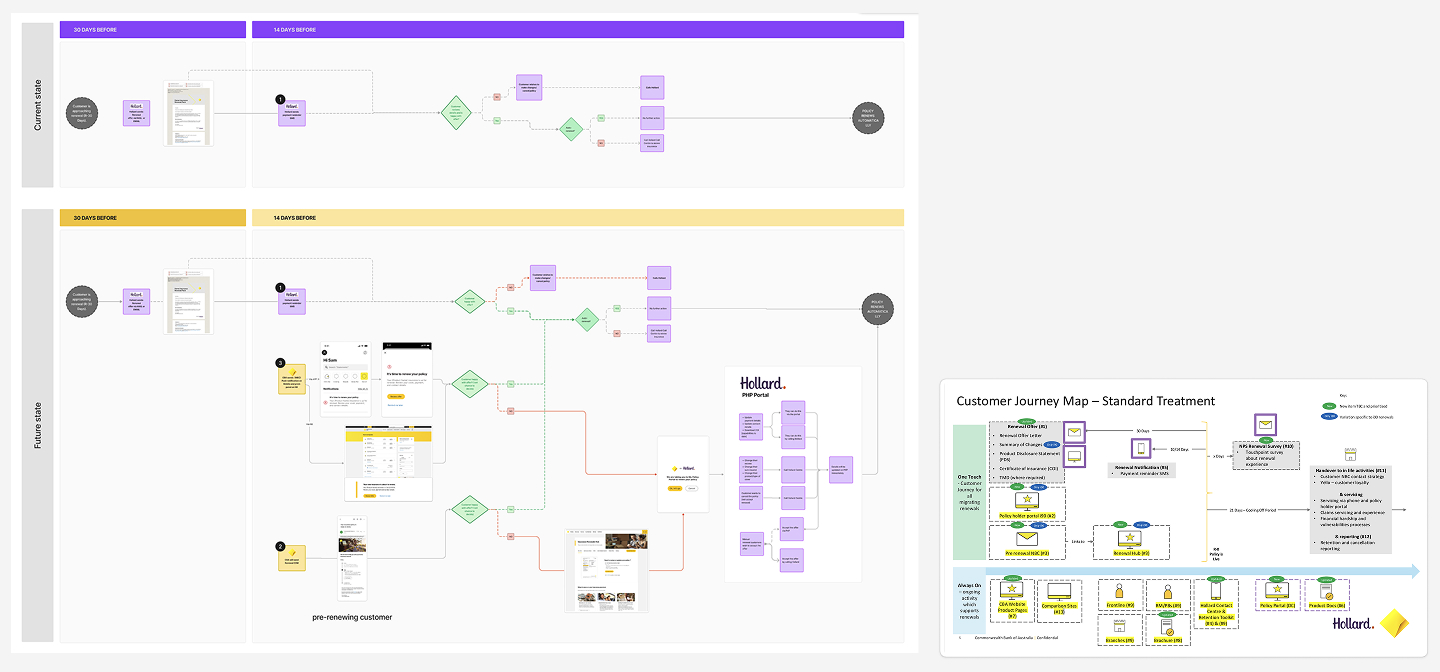

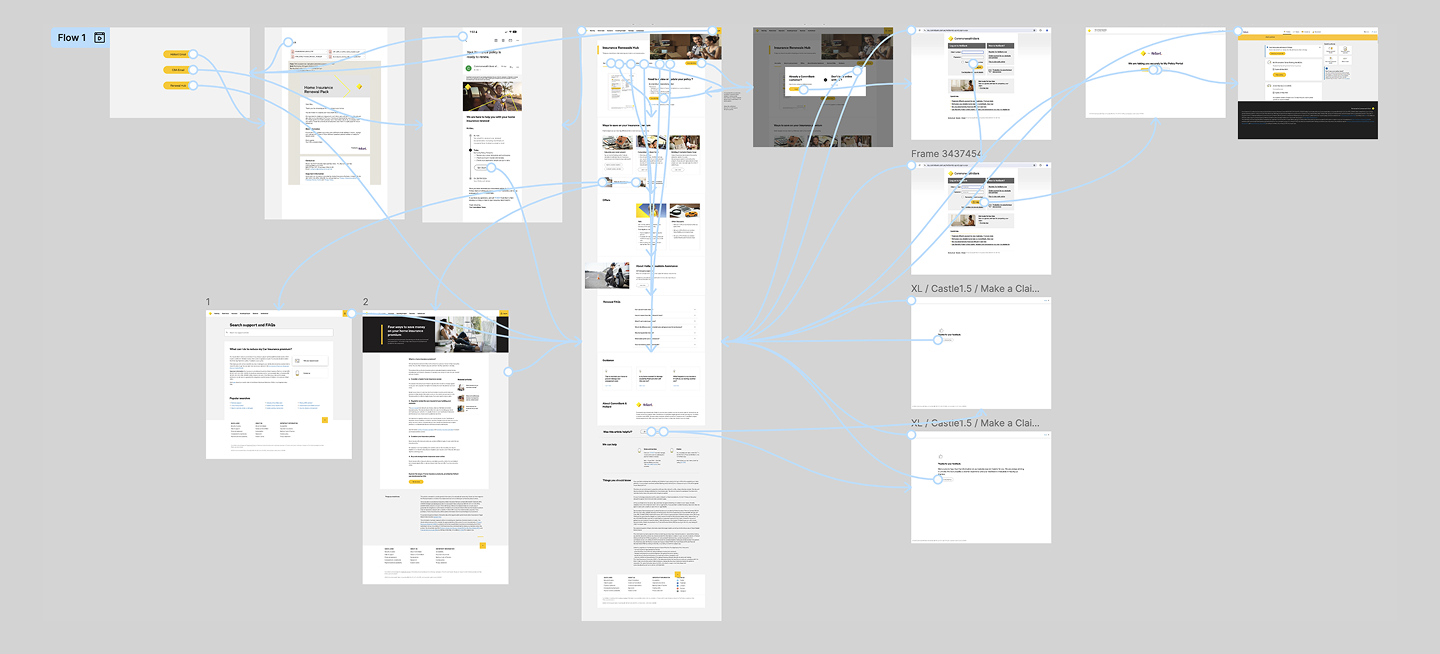

In this section, I analyzed the current state by mapping the user flow and identifying the main challenges. Customers needed more information about the renewal process, such as why price increases occur, how to manually accept their renewal, and how to update their insurance policies.

To address these issues, I created a future state user flow, highlighting opportunities for enhancement. We also introduced a streamlined process, providing customers with a comprehensive email linking to a website where all necessary information is readily available.

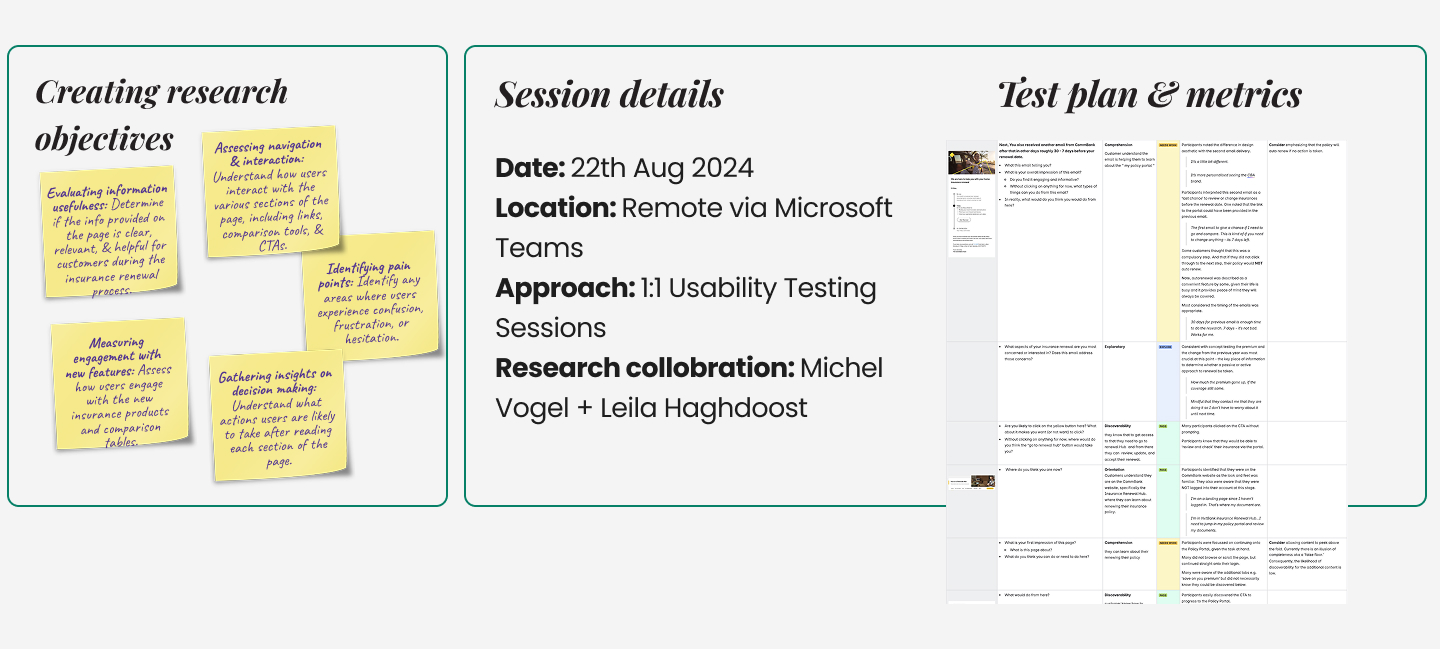

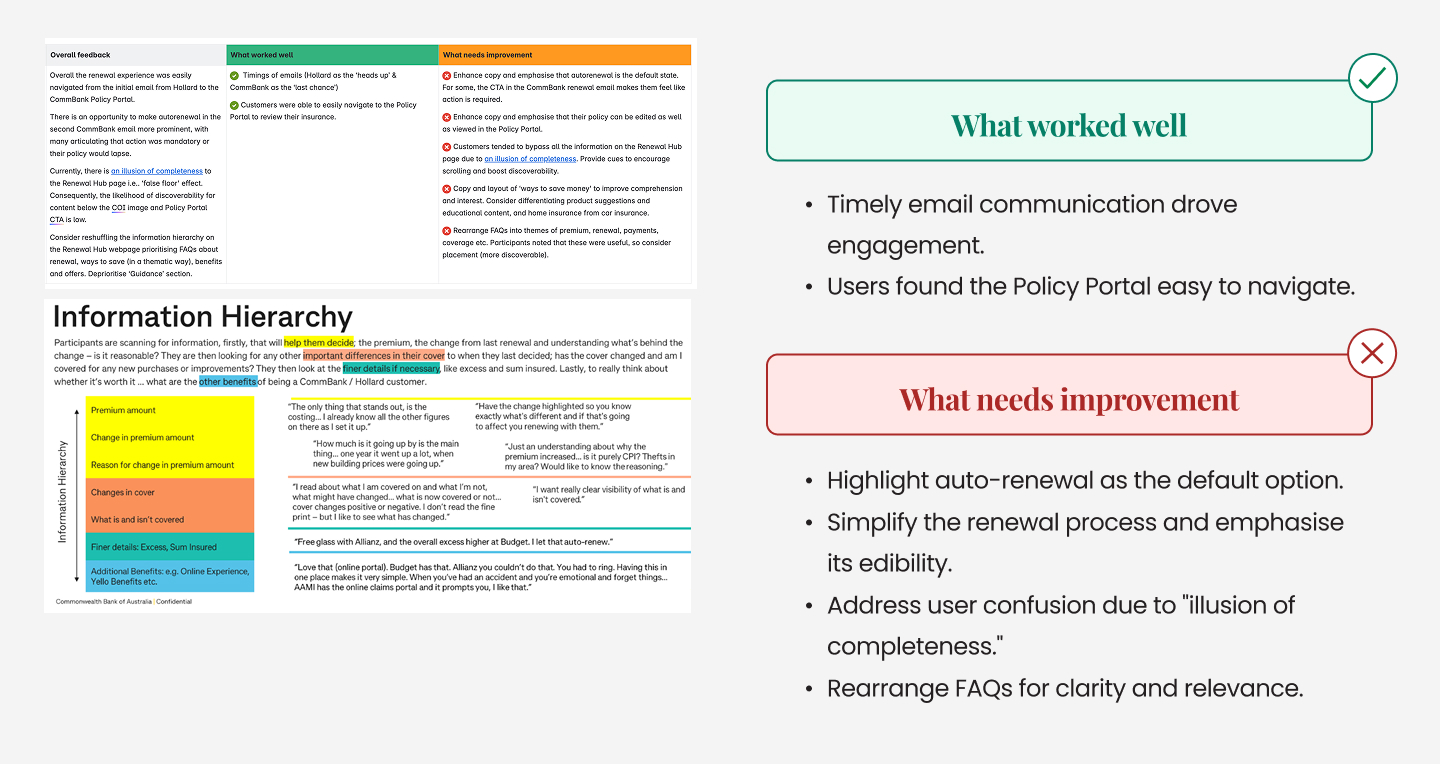

After developing the new experience ideas, I set specific customer research objectives and aligned with stakeholders to ensure everyone was on the same page. I then organized a meeting with the research team to walk them through the entire experience. I drafted a test plan with detailed scenarios and metrics for each task, which the researchers used during user research. I also developed a prototype for customer testing and tested the concept with six customers to gather feedback.

The renewal experience was generally smooth, with clear navigation between portals. However, there’s an opportunity to address user confusion around "illusion of completeness" and improve clarity on renewal options and FAQs.

After validating the concept through customer testing, I gathered insights and iterated on the design of the Renewal Hub. These iterations were based on feedback about what worked well and what needed improvement. I also refined the content and removed unnecessary elements that customers didn’t find valuable. Finally, we reached the final version of the page and handed it over to the publishing team for launch.

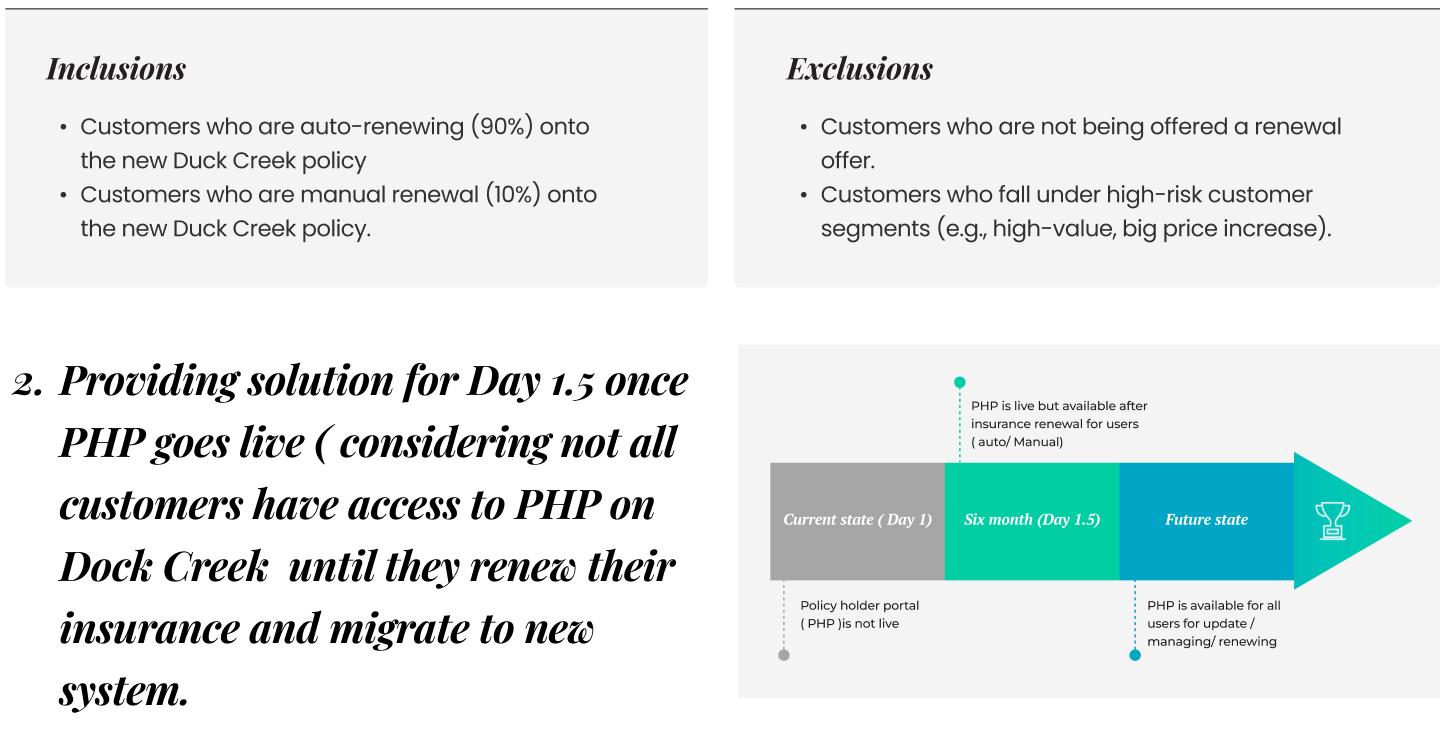

Finally, we are continuing to work on further enhancements to this page and process. These enhancements will be implemented once the PHP policy holder, managed by our partner, goes live. We are actively preparing ourselves to ensure that the new version of the Renewal Hub is ready to go live in sync with this update.